macies.ru

Community

Home Worth Less Than Mortgage

Negative equity occurs when the value of real estate property falls below the outstanding balance on the mortgage used to purchase that property. Note that a down payment of less than 20% will require mortgage loan I've heard that upfront and one-time costs of buying a home can be significant. Negative equity is when a house or flat is worth less than the mortgage you took out on it. If you're in negative equity you could find it hard to move house or. Home equity is the value you have built into your property; the more of your mortgage you've paid on your primary residence, the more equity you have. You can. The lender will work to establish the value of your property. This will often include an appraisal or inspection. Home equity loan processing times vary, but. Negative equity occurs when a property's value is less than the home loan owing on it. Here's an example: High iron ore and coal prices in the early s. Generally, a mortgage is considered underwater when the value of the home is less than the original mortgage principal.2 Depending on the decrease in the value. If you come up with a negative number, your house is worth less than what you owe, and you end up with negative equity. Having equity is valuable. It. It's called being underwater with the loan. You have four options. You can renegotiate the loan with some credit for some of the deficit. You. Negative equity occurs when the value of real estate property falls below the outstanding balance on the mortgage used to purchase that property. Note that a down payment of less than 20% will require mortgage loan I've heard that upfront and one-time costs of buying a home can be significant. Negative equity is when a house or flat is worth less than the mortgage you took out on it. If you're in negative equity you could find it hard to move house or. Home equity is the value you have built into your property; the more of your mortgage you've paid on your primary residence, the more equity you have. You can. The lender will work to establish the value of your property. This will often include an appraisal or inspection. Home equity loan processing times vary, but. Negative equity occurs when a property's value is less than the home loan owing on it. Here's an example: High iron ore and coal prices in the early s. Generally, a mortgage is considered underwater when the value of the home is less than the original mortgage principal.2 Depending on the decrease in the value. If you come up with a negative number, your house is worth less than what you owe, and you end up with negative equity. Having equity is valuable. It. It's called being underwater with the loan. You have four options. You can renegotiate the loan with some credit for some of the deficit. You.

You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. This. Learn if buying a house is a good investment and how to estimate how much your home is worth mortgage, then your home's equity will be less than its market. House prices have decreased at various times in the UK - and if this happens while you own a property, it may be worth less than what you owe on your mortgage. Try to negotiate with the seller to drop the price: It doesn't hurt to talk to the seller about the situation and note that the appraised value of the home was. Nothing as long as you keep making the payments. If you sell however, and the value is less than your mortgage, you will the bank money. A mortgage loan for 80% or less of the property's market value. Credit less than 20% of the purchase price. Default insurance premiums are paid by. A short sale, also known as a pre-foreclosure sale, is when you sell your home for less than the total debt remaining on your mortgage. A short sale is a way to. If you put down less than 20% of your home's value at the time of purchase, you likely pay toward private mortgage insurance, or PMI, each month. These payments. In order to do this, you have to reach out to your bank and see if they'll agree to let you sell your home for less than the amount that you owe on the mortgage. In the simplest terms, your home's equity is the difference between how much your home is worth and how much you owe on your mortgage. Look at this example. In a short sale, the homeowner initiates the sale of the home, but in order for a short sale to be plausible, the home must be worth less than the amount the. For most people, their home is their most valuable asset, so home equity is essential to your net worth and can help you achieve other financial goals. Below. Negative equity is when your property becomes worth less than the remaining value of your mortgage. To be in negative equity, the value of your house must fall. That means your balance goes up over time, increasing the amount you have to pay, and you have less and less equity in your home. Differences between regular. A good rule of thumb is to aim for your mortgage payment alone to be less than 28% of your current gross income and your total DTI ratio to be 45% or less . If you put down less than 20% of your home's value at the time of purchase, you likely pay toward private mortgage insurance, or PMI, each month. These payments. Ideally, this new loan comes with better terms than your old one. This depends on a number of factors, including current mortgage rates, how much equity you. If an appraisal comes in for less than the amount that you've agreed to pay, then the bank will only fund a mortgage based on the appraised value. For. Negative equity occurs when a property's value is less than the home loan owing on it. Here's an example: High iron ore and coal prices in the early s. Learn if buying a house is a good investment and how to estimate how much your home is worth mortgage, then your home's equity will be less than its market.

Price Of Lng Per Mmbtu

Dutch TTF Natural Gas (USD/MMBtu) (ICIS Heren) Front Month Futures - Quotes ; OCT TTEV4 · ; NOV TTEX4 · ; DEC TTEZ4 · ; JAN For example, if the price of LNG at Sabine Pass is $5 per MMbtu, the price of LNG in Europe is $10 per MMbtu, and the shipping costs from Sabine Pass to Europe. US Liquefied Natural Gas Exports Price is at a current level of , up from last month and down from one year ago. This is a change of %. Average Retail Fuel Prices in the United States ; Gasoline, , ; E85, , ; CNG, , ; LNG ; Propane*, , (1) Asian LNG prices are now at a $3/MMBtu premium to European LNG prices incentivizing more cargo flow to Asia. This will mitigate the slump in floating. IEC – uses one ton of natural gas as equal to mmbtu (as per IEC data book). IEC uses rate of 1 bcm = 35,, mmbtu. Thus, you take the price per ton . Spot LNG prices in northeastern Asia rose 40¢ to $/MMBtu, and prices in southwestern Europe fell 5¢ to $/MMBtu. JKM prices are $15 per million British thermal unit (MMBtu). Liquefaction per MMBtu it might receive for its natural gas at. Henry Hub. Under an IPM. Japan Liquefied Natural Gas Import Price is at a current level of , down from last month and down from one year ago. Dutch TTF Natural Gas (USD/MMBtu) (ICIS Heren) Front Month Futures - Quotes ; OCT TTEV4 · ; NOV TTEX4 · ; DEC TTEZ4 · ; JAN For example, if the price of LNG at Sabine Pass is $5 per MMbtu, the price of LNG in Europe is $10 per MMbtu, and the shipping costs from Sabine Pass to Europe. US Liquefied Natural Gas Exports Price is at a current level of , up from last month and down from one year ago. This is a change of %. Average Retail Fuel Prices in the United States ; Gasoline, , ; E85, , ; CNG, , ; LNG ; Propane*, , (1) Asian LNG prices are now at a $3/MMBtu premium to European LNG prices incentivizing more cargo flow to Asia. This will mitigate the slump in floating. IEC – uses one ton of natural gas as equal to mmbtu (as per IEC data book). IEC uses rate of 1 bcm = 35,, mmbtu. Thus, you take the price per ton . Spot LNG prices in northeastern Asia rose 40¢ to $/MMBtu, and prices in southwestern Europe fell 5¢ to $/MMBtu. JKM prices are $15 per million British thermal unit (MMBtu). Liquefaction per MMBtu it might receive for its natural gas at. Henry Hub. Under an IPM. Japan Liquefied Natural Gas Import Price is at a current level of , down from last month and down from one year ago.

Annual capacities of flow rates of facilities are often described in million tonnes per annum or millions of tonnes per year (these are the same thing). 18 $ per mmBtu. Spot Brent crude oil price. 20 40 60 80 $ per barrel. Spot LNG price. 0 5 10 15 20 $ per. Daily gas prices at Henry Hub began a steady run-up from $ per MMBtu in mid-June to $ in early October, before easing off to $ by mid-December. Exchange for Swap (EFS): 1 lot = 10, MMBtu. Block Order: 5 lots = 50, MMBtu. Price Quotation. The contract price is in United States dollar and cent per. Global price of LNG, Asia (PNGASJPUSDM) ; Jul ; Jun ; May ; Apr ; Mar The monthly settlement pricing is measured by USD/MMBtu —1,, British thermal units. Created with Highcharts *All prices in $ per MMBtu $/MMBtu. USD/MMBTU. øre/Sm³. NOK/Sm³, øre/Sm³, NOK/kWh, øre/kWh, €/kWh, c€/kWh, €/MWh, p/cf, p/kWh, p/Sm³, p/therm, USD/MMBTU. More options click to expand contents. Yet in the first decade of the millennium, natural gas prices averaged nearly $8 per MMBtu, after adjusting for inflation. So today's price—$/MMBtu at press. per million Btu (MMBtu), as opposed to nearly $16 per MMBtu in Spot LNG prices have already plummeted. A bright side of lower prices is that they. Natural gas US prices averaged USD per MMBtu in July, down % from June. On 31 July, the commodity traded at USD per MMBtu, down % from Natural Gas Price: Get all information on the Price of Natural Gas , USD per MMBtu, 9/6/24 PM. Ethanol, , , USD per Gallon, 9/6/ Henry Hub Natural Gas Spot Price, (US$/MMBtu) ; First Day Of The Month Prices, $, $ ; Rolling month FDOM Average, $, $ ; Monthly Average Daily. The price of Japan Liquefied Natural Gas (LNG) in International Commodity Markets for Jul is dollars per mmbtu. Weather, demand and supply continued to affect the market prices. On. July 1, the NYMEX August contract settled at $ per MMBtu, a decrease of cents. IEC – uses one ton of natural gas as equal to mmbtu (as per IEC data book). IEC uses rate of 1 bcm = 35,, mmbtu. Thus, you take the price per ton . Contract Specifications EEX Platts JKM® LNG Natural Gas Futures ; Pricing, In USD per MMBtu to the third decimal place after the point ; Price Tick, USD per. Estimated total capital cost savings using LNG over LPG, per capital investment ≈ $1,, Total MMBTU savings with LNG over LPG, per annum ≈ $, ANZ Research forecast the LNG spot price to drop to an average of $32/MMBtu in and $/MMBtu in , compared with an estimated $/MMBtu in The. FOR most of the first quarter, the price of liquefied natural gas (LNG) has been languishing at less than US$3 per million British thermal unit (mmBtu). Weather, demand and supply continued to affect the market prices. On. July 1, the NYMEX August contract settled at $ per MMBtu, a decrease of cents.

What Investments To Put In Roth Ira

What is a Roth IRA? A Roth IRA is a retirement account where you may be able to contribute after-tax dollars and you don't have to pay federal tax on “. Can I have both a Roth IRA and invest in mutual funds simultaneously? Absolutely, you can maintain a Roth IRA while investing in mutual funds. One provides. Make sure that the amount of any stocks, bonds, and short-term securities in your asset mix reflects your time frame for investing and the associated need for. contribute to a Roth IRA. maximum income: $, (filing single) or $, (filing joint). PNC Investments offers two convenient ways to manage your. 1. A Roth IRA is a type of tax-advantaged retirement savings account. · 2. You contribute after-tax dollars to a Roth, but the money grows tax-free—and so are. Contribute using your after-tax dollars · Enjoy potentially tax-free growth for your assetsFootnote · Make withdrawals without paying income tax · Invest in stocks. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and. Rollovers and Roth conversions · Recharacterization of IRA Contributions · Investments. Contributions. How much can I contribute to an IRA? The annual. Fidelity believes one of the best ways to do that over the long term is by considering an appropriate amount to invest in a diversified portfolio of stock. What is a Roth IRA? A Roth IRA is a retirement account where you may be able to contribute after-tax dollars and you don't have to pay federal tax on “. Can I have both a Roth IRA and invest in mutual funds simultaneously? Absolutely, you can maintain a Roth IRA while investing in mutual funds. One provides. Make sure that the amount of any stocks, bonds, and short-term securities in your asset mix reflects your time frame for investing and the associated need for. contribute to a Roth IRA. maximum income: $, (filing single) or $, (filing joint). PNC Investments offers two convenient ways to manage your. 1. A Roth IRA is a type of tax-advantaged retirement savings account. · 2. You contribute after-tax dollars to a Roth, but the money grows tax-free—and so are. Contribute using your after-tax dollars · Enjoy potentially tax-free growth for your assetsFootnote · Make withdrawals without paying income tax · Invest in stocks. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and. Rollovers and Roth conversions · Recharacterization of IRA Contributions · Investments. Contributions. How much can I contribute to an IRA? The annual. Fidelity believes one of the best ways to do that over the long term is by considering an appropriate amount to invest in a diversified portfolio of stock.

Then, under “Invest” select your Roth IRA. From there, you can manage your account and see its performance. Q: Can you withdraw from a Roth IRA? Roth IRAs let you invest for retirement today and withdraw tax-free later. Open a Roth to experience Betterment's retirement advice and technology. You can contribute to a Roth IRA at any age if you have earned income (earnings from employment, including self-employment or alimony, not investment or rental. A Roth IRA conversion occurs when you take savings from a Traditional, SEP or SIMPLE IRA, or qualified employer-sponsored retirement plan (QRP), such as a Mutual funds from other companies · Stocks · ETFs · CDs · Bonds. If you want to invest your IRA, TIAA can help you assess your IRA investment options. Learn how to invest your ira and find out what suits your plan the. A Roth IRA is an individual retirement account that allows you to invest after-tax contributions. Unlike a Traditional IRA, distributions from Roth IRAs may be. Many people like mutual funds (no load Mutual Funds of course) because of the instant diversification they provide, but you can also invest in individual stocks. With a traditional IRA, you're able to make contributions with pre-tax dollars, reducing your taxable income for that year by the amount you contribute. However. A Roth IRA with Thrivent Mutual Funds is an individual retirement account to which you make contributions with money on which you've already paid taxes. A Roth IRA can be an advantage to your overall retirement strategy, as it offers tax-free growth and withdrawals. It can help you minimize taxes when you. One example of an income-producing asset to add to your Roth IRA portfolio is a dividend stock fund. These funds specifically invest in dividend stocks, which. In a lower tax bracket · Wanting more spendable income · Ready to invest at least $1, · Needing flexibility · Nearing retirement · Not sure which IRA is right for. You can open a Roth IRA in a mutual fund or in an exchange-traded fund (ETF) or other investment vehicle through our brokerage service. Mutual Funds. Select. A Roth IRA allows for tax-deferred investment: You pay taxes on your contributions at the time you put money in and any growth is tax-free. Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA Roth IRA · E*Trade Roth. contribute or provide investment help. CalSavers offers investment options However, not everyone is eligible to contribute to a Roth IRA and savers. It is not possible to invest directly in an index and the compounded rate of return noted above does not reflect sales charges and other fees that investment. Except for rollover contributions (see the section Rollovers to Your IRA), all contributions to an IRA must be made in cash. No deduction is allowed for any. Roth IRA vs. Traditional IRA. No matter what stage of life you're in, it is never too soon to start planning for retirement, as even the small.

Price Of Gamestop Stock

On Tuesday 09/10/ the closing price of the GameStop Corp share was $ on BTT. Compared to the opening price on Tuesday 09/10/ on BTT of $ Stock price history for GameStop (GME). Highest end of day price: $ USD on Lowest end of day price: $ USD. % · Previous Close · Open · Bid x · Ask x · Day's Range - · 52 Week Range - · Volume 15,, View GameStop Corp. Class A GME stock quote prices, financial information, real-time forecasts, and company news from CNN. r/Gamestopstock: gamestop stock price, story, graph, news and all of them belong to the gamestop company. and Gamestop near me. Stock analysis for GameStop Corp (GME:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Key Data ; Exchange. NYSE ; Sector. Consumer Discretionary ; Industry. Electronics Distribution ; 1 Year Target. $ ; Today's High/Low. $/$ Today's GME Stock Price for GameStop NYSE: GME stock rating, related news, valuation, dividends and more to help you make your investing decisions. The current price of GME is USD — it has decreased by −% in the past 24 hours. Watch GameStop stock price performance more closely on the chart. On Tuesday 09/10/ the closing price of the GameStop Corp share was $ on BTT. Compared to the opening price on Tuesday 09/10/ on BTT of $ Stock price history for GameStop (GME). Highest end of day price: $ USD on Lowest end of day price: $ USD. % · Previous Close · Open · Bid x · Ask x · Day's Range - · 52 Week Range - · Volume 15,, View GameStop Corp. Class A GME stock quote prices, financial information, real-time forecasts, and company news from CNN. r/Gamestopstock: gamestop stock price, story, graph, news and all of them belong to the gamestop company. and Gamestop near me. Stock analysis for GameStop Corp (GME:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Key Data ; Exchange. NYSE ; Sector. Consumer Discretionary ; Industry. Electronics Distribution ; 1 Year Target. $ ; Today's High/Low. $/$ Today's GME Stock Price for GameStop NYSE: GME stock rating, related news, valuation, dividends and more to help you make your investing decisions. The current price of GME is USD — it has decreased by −% in the past 24 hours. Watch GameStop stock price performance more closely on the chart.

GameStop traded at $ this Monday September 9th, increasing $ or percent since the previous trading session. Looking back, over the last four weeks. (NYSE: GME) Gamestop currently has ,, outstanding shares. With Gamestop stock trading at $ per share, the total value of Gamestop stock (market. GS2C | Complete GameStop Corp. Cl A stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. The closing price for GameStop (GME) in was $, on December 31, It was up % for the year. The latest price is $ 20 minutes ago. Access real-time $GameStop Corp. stock insights on eToro. ➤ View prices, charts, and analyst price target ✓ Invest in GME Now. Track GameStop Corp (GME) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Stock SaleGameStop announced that it had completed the sale of all 75 million shares for gross proceeds of $ billion at an average share price of $ The live GameStop price today is $ USD with a hour trading volume of $ USD. We update our GME to USD price in real-time. In depth view into GME (GameStop) stock including the latest price, news, dividend history, earnings information and financials. What Is the GameStop Corp Stock Price Today? The GameStop Corp stock price today is What Is the Stock Symbol for GameStop Corp? The stock ticker symbol. View the real-time GME price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The range. See GME stock price and Buy/Sell GameStop. Discuss news and analysts' price predictions with the investor community. GameStop Corp. offers games and entertainment products through its ecommerce properties and stores. It operates through the following geographic segments. GameStop Corp. Cl A ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - The stock closed at $ per share. The share price continued rising in early , reaching an all-time intraday high of $ on January 28, posting a. On March 24, the GameStop stock price fell 34 percent to $ per share after earnings were released and the company announced plans for issuing a new. The latest closing stock price for GameStop as of September 09, is · The all-time high GameStop stock closing price was on January 27, GameStop (GME) Stock Moves %: What You Should Know. GameStop (GME) closed the most recent trading day at $, moving % from the previous trading.

What Is Trading With Leverage

Leverage trading is a high-risk/high-reward trading strategy that experienced investors use with the aim of increasing their returns. More precisely saying, due to leverage traders are able to trade higher volumes. Investors having small capitals prefer trading on margin (or with leverage). Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. · Brokerage accounts allow. The sum amount invested by an individual, including the collateral provided is called the margin, and this practice develops a trading power called. Give me the lowdown. Leveraged trading is all about borrowing money to make a trade or longer-term investment. The basic principle is simple. Investment gains. What is leverage in trading? Leverage in trading is a system by which traders can enter much larger positions than what they could open with their own capital. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Essentially, you're putting down a fraction. Leverage in forex is a technique that enables traders to 'borrow' capital in order to gain a larger exposure to the forex market. Learn about using leverage. Leverage gives traders the ability to trade larger value contracts while putting down relatively smaller amounts upfront. This provides traders with greater. Leverage trading is a high-risk/high-reward trading strategy that experienced investors use with the aim of increasing their returns. More precisely saying, due to leverage traders are able to trade higher volumes. Investors having small capitals prefer trading on margin (or with leverage). Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. · Brokerage accounts allow. The sum amount invested by an individual, including the collateral provided is called the margin, and this practice develops a trading power called. Give me the lowdown. Leveraged trading is all about borrowing money to make a trade or longer-term investment. The basic principle is simple. Investment gains. What is leverage in trading? Leverage in trading is a system by which traders can enter much larger positions than what they could open with their own capital. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Essentially, you're putting down a fraction. Leverage in forex is a technique that enables traders to 'borrow' capital in order to gain a larger exposure to the forex market. Learn about using leverage. Leverage gives traders the ability to trade larger value contracts while putting down relatively smaller amounts upfront. This provides traders with greater.

In order to employ leverage, a trader needs to have sufficient funds in his account to cover possible losses. Each broker has different requirements, and. If your broker offers leverage of , with their backing, you could manage a position of up to $, with a margin of $ If Google's share price doubled in. The Bottom Line. Leverage trading can be dangerous and can also lead to potentially big profits. Like anything in trading, it's just a tool. Working it into. Leverage is a trading tool that enables you to control a large amount of capital without paying for the full value of your position upfront. Leverage ratio is a measurement of your trade's total exposure compared to its margin requirement. Your leverage ratio will vary, depending on the market you're. In simple terms, it is the ratio between the amount of money you can trade over the amount of money you have. For instance, a leverage ratio means you. How does leverage work? Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Essentially, you're. Why do traders use leverage? As we've seen, a key benefit is that it allows traders to access bigger trades with less upfront capital. The other key benefit. While ASIC-regulated brokers can offer retail forex traders a maximum of leverage for major currency pairs. That means for every $1, you invest, you can. Leverage in trading means using borrowed money to speculate on the price of a financial asset, such as a stock or commodity. Leverage can amplify gains (if. Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. The margin needed to open each trade is derived from the leverage limit associated with the instrument that you wish to trade. For example, if your leverage is. The higher the leverage or lower the margin in online trading, the greater the maximum exposure you can get and the greater the reward and risk. Your trading. Leverage is a ratio representing the level of exposure you have to a trade. Using leverage means you can control trades of higher value than the margin you hold. The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade larger positions in a currency. As a result. Using high levels of leverage. At excessively high levels (higher than those available at IG), leverage exerts another effect. In addition to simple. In its most primary form, leverage trading is any type of trading that includes borrowing money or otherwise raising the number of shares involved in a deal. If you meet the criteria for using leverage or opening a margin account to trade, it's relatively easy to access the funds and open bigger positions. Sometimes. Leverage trading refers to the ratio applied to the marginal amount deposited. It is illustrated through ratios such as , , and So if a.

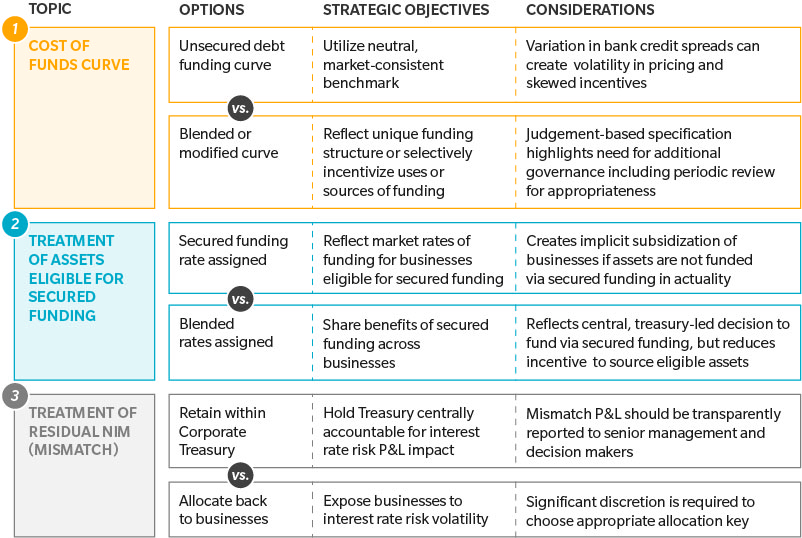

Ftp Transfer Pricing

FTP drivers used by banks generally fall into three areas: attempts to price risk into products, attempts to price regulatory cost into products, and. Funds Transfer Pricing or FTP is a methodology used to calculate relative profitability of all interest baring transactions in a financial institution. The Fund Transfer Pricing (FTP) measures the contribution by each source of funding to the overall profitability in a financial institution. FTP informs banks over a range of critical areas such as pricing, risk transfer, performance management and strategic decision making, to name a few. FTP has. » All of this has had an impact on fund transfer pricing (FTP) methodologies. How should the Treasury function in banks respond? Chart 1: Household savings. FTP is an internal allocation and measurement mechanism for determining the pricing of incremental loans/investments/deposits and for determining the profit. Funds Transfer Pricing in essence is a process to determine whether a bank is making money or will “bite the dust”. One of the first common misconceptions of. Additionally, FTP can help determine pricing. If you have a loan pricing system, you'll want to include FTP as part of that calculation — which can change the. In this case, the basic FTP for the loan will be %p.a. for the whole principal for the first year (it will change in a year at the current. FTP drivers used by banks generally fall into three areas: attempts to price risk into products, attempts to price regulatory cost into products, and. Funds Transfer Pricing or FTP is a methodology used to calculate relative profitability of all interest baring transactions in a financial institution. The Fund Transfer Pricing (FTP) measures the contribution by each source of funding to the overall profitability in a financial institution. FTP informs banks over a range of critical areas such as pricing, risk transfer, performance management and strategic decision making, to name a few. FTP has. » All of this has had an impact on fund transfer pricing (FTP) methodologies. How should the Treasury function in banks respond? Chart 1: Household savings. FTP is an internal allocation and measurement mechanism for determining the pricing of incremental loans/investments/deposits and for determining the profit. Funds Transfer Pricing in essence is a process to determine whether a bank is making money or will “bite the dust”. One of the first common misconceptions of. Additionally, FTP can help determine pricing. If you have a loan pricing system, you'll want to include FTP as part of that calculation — which can change the. In this case, the basic FTP for the loan will be %p.a. for the whole principal for the first year (it will change in a year at the current.

Within many banks, Funds Transfer Pricing (FTP) frameworks were implemented a decade or two ago, and are long overdue for an upgrade. As the profitability. Fund Transfer Pricing (FTP) is a key component of the mechanism used to price all assets and liability products offered by a financial institution. A comprehensive and well-functioning FTP framework is necessary for any depository institution to understand how it makes money. Comptroller of the Currency, is issuing guidance to clarify supervisory expectations for an effective funds transfer pricing (FTP) framework. The guidance. FTP determines the net interest margin of each individual account being analyzed for profitability. This includes the assignment of a cost of funding (COF). This course will give participants a platform for discussion and learning how to apply the process of FTP to business functions. units are called Funds Transfer Pricing (FTP) methodologies. FTP is not only a vital tool for managing a company's balance sheet and measuring the risk. Funds Transfer Pricing [FTP] is critical to banks internal management of liquidity, funding and interest rate risk. Whilst regulators do not specify what FTP. It is vital in ensuring a minimum threshold of profitability, while integrating the pricing process into modern and scalable architectures. Historically, fund transfer pricing (FTP) mechanisms had been conceived as a tool to provide a consistent and fair means by which banks could resolve this. The funds transfer pricing (FTP) methodology determines the cost of funds associated with the lending and borrowing from a financial institution (for. Again, there will be a need for a specific fund transfer price to evaluate the cost of funding loans. Appropriate identification of the FTP is fundamental for. FTP is a vital financial tool used by banks and financial institutions to assess profitability, manage risks, and make informed decisions. Banks use fund transfer pricing models to price assets they finance based on the blended cost of their deposits and wholesale funding. For products with contractual maturity, FTP rates are calculated and applied at the transaction level based on their contractual maturity (fixed. It is vital in ensuring a minimum threshold of profitability, while integrating the pricing process into modern and scalable architectures. Funds transfer pricing (FTP) is an internal process to assign funding rates to interest-earning assets and earning rates to fund-generating liabilities of a. The FTP Rate process calculates the funds transfer pricing base rate for renewed or extended instruments using the minimum cost of funds rates in effect during. FTP rates are used in instrument pricing to represent the marginal cost of raising new money to fund a new loan. Many organizations (About 50%) mistakenly use.

Ap Accrual

This journal entry is a debit to the Accounts Payable account and a credit to the Cash account. However This expense needs to be accrued so it's recorded in. Certify AP has a large set of reports which enable administrators and managers to analyze spend data. The Accrual Report is a permission. In the accounts payable accrual process, accrued expenses are charges you are obligated to pay in the future for goods and/or services already rendered. accrued through the Accounts Payable system. Posting the Items Received but Not Invoiced Accruals. The NCAS system creates an accrual batch of transactions. Details. This includes: AP Accruals: Expenses for goods and services received in FY24 that have not been paid for in FY24; AR Accruals: Revenue earned in FY This chapter provides the financial management policy for recording accruals for both intragovernmental and non-federal accounts payable. The accounts. The Accrual Reconciliation Report lets you determine how much you should have paid and whether the PO or invoice is correct. Such differences leave residual. Year-End Accrual Spreadsheet. AP Accrual. A, B, C, D, E, F, G, H, I, J, K, L, M. 1, Item, Invoice No. (I-doc), Vendor Inv, Date Entered on Spreadsheet, Amount. AP Accrual · 1) You need to pass following Journal Entry In Transaction-->Financial-->General. Expenses A/c Dr $$$ · 2) When you are ready to make Invoice for. This journal entry is a debit to the Accounts Payable account and a credit to the Cash account. However This expense needs to be accrued so it's recorded in. Certify AP has a large set of reports which enable administrators and managers to analyze spend data. The Accrual Report is a permission. In the accounts payable accrual process, accrued expenses are charges you are obligated to pay in the future for goods and/or services already rendered. accrued through the Accounts Payable system. Posting the Items Received but Not Invoiced Accruals. The NCAS system creates an accrual batch of transactions. Details. This includes: AP Accruals: Expenses for goods and services received in FY24 that have not been paid for in FY24; AR Accruals: Revenue earned in FY This chapter provides the financial management policy for recording accruals for both intragovernmental and non-federal accounts payable. The accounts. The Accrual Reconciliation Report lets you determine how much you should have paid and whether the PO or invoice is correct. Such differences leave residual. Year-End Accrual Spreadsheet. AP Accrual. A, B, C, D, E, F, G, H, I, J, K, L, M. 1, Item, Invoice No. (I-doc), Vendor Inv, Date Entered on Spreadsheet, Amount. AP Accrual · 1) You need to pass following Journal Entry In Transaction-->Financial-->General. Expenses A/c Dr $$$ · 2) When you are ready to make Invoice for.

In simple terms, an accounts payable accrual refers to the recognition of expenses that have been incurred but not yet paid for by a company. It serves as a. How to use Accruals in Accounts Payables Entering Credit Card Purchases. In addition to recording as accounts payable the liability for A prior actual accrual or a trend of several previous periods may be appropriate when. Organisations should represent costs they have brought about previously or which will come due later on. Accrual accounting is a strategy for following such. An accrual, or accrued expense, is a means of recording an expense that Accruals differ from Accounts Payable transactions in that an invoice is. Any AP accrual entry needs to be submitted to your Business. Analyst by NOON JULY Expense Accrual Examples: • Accounts Payables – used when goods or. AP, PO, Cutoff. • AP Accrual. • Items entered into AP before June • Non-PO vouchers entered in AP before June 30, but not yet approved, will be accrued. In order to understand how the report determines which invoices were accrued, you must have a general understanding of the AP Accrual process. For further. and account (AP Accrual End-of-Year). However, fund 5 cost centers will not be accrued to avoid early recognition of revenue through the Revenue. The official business definition of the Ap Accrual Process is the accounting process of recognizing revenue and expenses at the time they are earned or. accrual account (normally the Expense A/P Accrual Account defined in the Define Purchasing Options form). You reverse accrual journal entries manually at. Under the cash basis method, we would record the expense for invoice based expenses when the company pays the invoice. However, under the accrual method, the. Overview. The macies.ru Year-End AP Accrual report was created to identify the accounts payable (AP) invoices that were included in the automatic AP accrual. THE SHORT ANSWER: Accounts Payable (AP) and Accrued Expenses (AE) work in a VERY similar way IF they both correspond to Operating Expense line items, or other. Basically, accounts payable are a type of accrued expense though right? We incur the expense but have invoices to show for it but we haven't. The accrual entries are prepared to post in the General Ledger (GL) only with project numbers for outstanding AP expenses of $2, or more that are in Oracle. An accrual method allows a company's financial statements, such as the In the above example, everything but accounts payable are accrued expenses. accrual or full accrual basis to private The August salary payroll and related payroll costs (reported as payroll payable, not accounts payable). Accrued Expenses Payable is a liability account that records amounts that are owed, but the vendors' invoices have not yet been received and/or have not yet. This policy sample establishes guidelines organizations should follow when recording and issuing accounts payable transactions.

Rental Property Computer Programs

AppFolio Property Manager · RealPage · Innago · Rent Manager · Yardi Breeze · DoorLoop · Property Matrix · Condo Control. Entrata property management software connects all of your property data and processes, allowing you to create better experiences for everyone. We ranked Buildium as the best rental property management software overall because its features are robust, its platform can scale with your portfolio's growth. AppFolio Property Manager unlocks new possibilities for your business all on one powerful platform. No matter what your needs might be. Tenant portal — Property management software provides a portal for tenants to communicate with property managers, pay rent, and submit service requests. Choose from two innovative platforms designed for real estate management: Yardi Voyager and Yardi Breeze. Both include accounting, operations and ancillary. Innago's free rental property management software makes it easy for small to mid-sized landlords to collect rent, sign leases, and manage tenants online. Innago is a free, easy-to-use property management software solution, designed to save you time & money. Our mission is to make renting simple, accessible, &. All-in-one property management software that helps property managers and owners make more money, get organized, and grow. AppFolio Property Manager · RealPage · Innago · Rent Manager · Yardi Breeze · DoorLoop · Property Matrix · Condo Control. Entrata property management software connects all of your property data and processes, allowing you to create better experiences for everyone. We ranked Buildium as the best rental property management software overall because its features are robust, its platform can scale with your portfolio's growth. AppFolio Property Manager unlocks new possibilities for your business all on one powerful platform. No matter what your needs might be. Tenant portal — Property management software provides a portal for tenants to communicate with property managers, pay rent, and submit service requests. Choose from two innovative platforms designed for real estate management: Yardi Voyager and Yardi Breeze. Both include accounting, operations and ancillary. Innago's free rental property management software makes it easy for small to mid-sized landlords to collect rent, sign leases, and manage tenants online. Innago is a free, easy-to-use property management software solution, designed to save you time & money. Our mission is to make renting simple, accessible, &. All-in-one property management software that helps property managers and owners make more money, get organized, and grow.

Stessa is a leading property management tool that empowers investors and managers to optimize their rental properties' performance. All in One Property Rental and Tenant Management Software; Rental Property Manager (Online Access Code Card) Win, Mac, Smartphone. iGMS is vacation rental software that helps property managers and Airbnb hosts to automate their short-term rental business. Start a free day trial. Rently offers self-guided touring, smart home, and rental screening as leasing automation solutions for the rental housing industry. TenantCloud rental property management software allows you to efficiently collect and monitor rent payments, track late fees, and generate income reports. Time. Bidrento is a user-friendly software designed for the management of rental properties, taking into account the real wishes and needs of people and companies. Hostaway is a unique Vacation Rental Property Management Software and Channel Manager which scales up with your success. A basic and free software system to track manage a small number of rental properties. Ideally for residential and I don't need anything too complicated. Rent Manager is powerful property management software that combines all the features you need to run your business into one integrated solution. Exceptionally. Rent Manager is a powerful property management software tool that combines all the features you need to run your business into one integrated platform. Landlord Studio offers free landlord software for hassle-free property management. Manage real estate accounting, tenant screening, and online rent. Rentec Direct property management software has the highest customer service rating, free online tenant payments, and unlimited US-based support. See how Buildium's property management software lets you control your day-to-day tasks, offer top app experiences, and uncover new revenue. Rentec Pro is the easiest to learn software and is backed by our #1 customer rated US-based client support team. Check out these software platforms and apps that eliminate the time-consuming tasks and streamline how you manage your properties, your tenants, and your. Everything you need, for every type of property. Financials, rentals, documents, occupancy & more. Get the tools you need to tackle it all. Accounting Software for Rental Property Owners. Get set up in minutes. Track income and expenses. Handle tax time. Get on with your life. Get today's leading rental property management software from Schedule My Rent. It's easy for both you and your tenants. Contact us today to schedule a demo. Avail is a free rental property management software solution, which was founded in the US in by working professionals who are also part-time landlords. Tenant portal — Property management software provides a portal for tenants to communicate with property managers, pay rent, and submit service requests.